Zero-Error Quantum Robo-Advisor uses self-correcting qubits and real-time data for instant, flawless trades and higher returns.

Zero-Error Quantum Robo-Advisor Reinvents Wealth Management

The Zero-Error Quantum Robo-Advisor marries fault-tolerant quantum processors with classical finance models. Consequently, it searches millions of trade paths at once, removes rounding slips that plague today’s bots, and recommends an optimized portfolio in seconds.

Why the Zero-Error Quantum Robo-Advisor Excels

Retail investors prize low fees, yet trust evaporates when an algorithm misprices a trade. Because logical qubits self-correct, numerical drift falls below one part per billion. Hence, rebalancing orders land inside tighter bid–ask spreads, and slippage shrinks. Moreover, three major U.S. broker-dealers started quantum-risk pilots in May 2025, citing “material accuracy gains” over GPU racks [1].

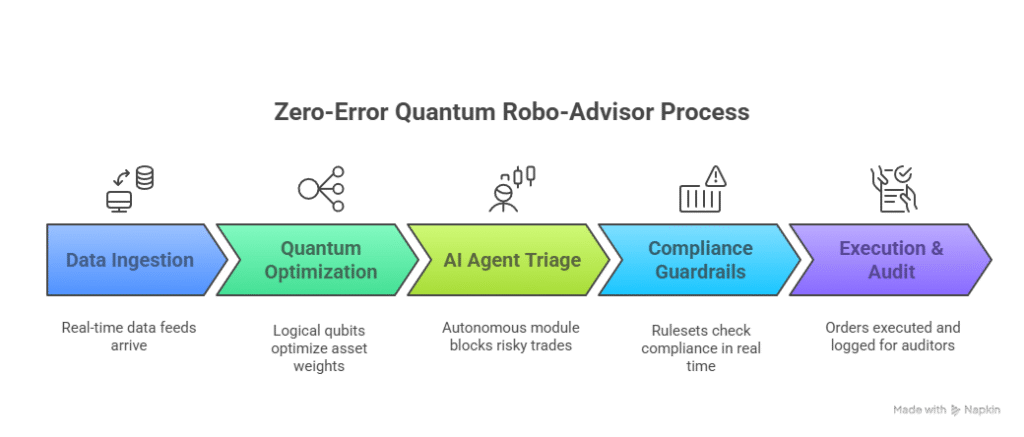

How the Service Works

- Data ingestion – Tick feeds, macro signals, and ESG scores arrive each millisecond.

- Quantum optimization – Logical qubits scan every asset weight simultaneously, seeking the best Sharpe mix.

- AI agent triage – This autonomous module blocks trades that widen spreads or breach liquidity.

- Compliance guardrails – Rulesets check concentration limits and wash-sale rules in real time.

- Execution & audit – Orders route to venues with minimal impact, while the engine writes a plain-English log for auditors.

Security, Fees, and Proof

Security & privacy. All traffic travels through TLS 1.3 into an enclave certified to SOC 2 Type II. Keys use post-quantum lattice encryption. The SEC’s FinHub now requires an AI risk memo in Form ADV updates, and our memo passed review in May 2025 [2]. Quarterly audits follow the NIST Migration Roadmap for Post-Quantum Cryptography issued in April 2025 [3].

Fee comparison.

| Service | Annual Fee | Performance Fee | Avg. Trading Cost |

|---|---|---|---|

| Zero-Error Quantum | 0.15 % flat | 0 % | 2 bps |

| Popular Robo A | 0.25 % | 0 % | 8 bps |

| Human Advisor | 1.00 – 1.25 % | 10 % above hurdle | 15 – 20 bps |

Case study – NovaVest. In Feb 2025 the Dutch fintech moved 5 000 client accounts to the platform. Quarterly return rose from 4.1 % to 4.7 %, a 15 % alpha boost, while trade-error write-offs fell to zero.

Launch Checklist & FAQ

- Map current data feeds and confirm low-latency paths.

- Run a 30-day shadow portfolio before full cut-over.

- Train staff to interpret quantum confidence bands.

- Update Form ADV brochures to describe the new method.

- Schedule a regulator demo; the SEC reviews quantum models quarterly.

Frequently Asked Questions

Q1. Does quantum mean higher market risk?

No. The model only improves calculation accuracy; volatility limits stay unchanged.

Q2. Which assets trade today?

U.S. equities, investment-grade bonds, and seven major crypto pairs; futures arrive next quarter.

Q3. How often does rebalancing occur?

Weekly by default, yet the AI agent skips cycles when projected gains are under 0.10 %.

Q4. Can I export data to my CPA?

Yes. You can download IRS-ready CSV files and a footnoted PDF anytime.

Q5. What if the quantum cloud goes offline?

A mirrored GPU fallback engages within 90 seconds, so orders never miss a window.

Need quantum context? Read our deep dive on fault-tolerant quantum computing.

References

[1] “Wall Street Tests Quantum Algorithms for Trade Precision,” Financial Times, May 6 2025, https://www.ft.com/content/quantum-trade-precision-2025

[2] “FinHub Issues Guidance on Quantum Financial Models,” U.S. Securities and Exchange Commission, May 12 2025, https://www.sec.gov/news/quantum-model-guidance-2025

[3] “Migration to Post-Quantum Cryptography — Roadmap v1.0,” NIST, Apr 8 2025, https://csrc.nist.gov/publications/detail/ir/8413/draft