AI budget coaches are revolutionizing personal finance—offering tailored advice, real‑time tracking, and automated saving strategies to help everyday users reach goals without stress.

What Is an AI Budget Coach—and Why It Matters

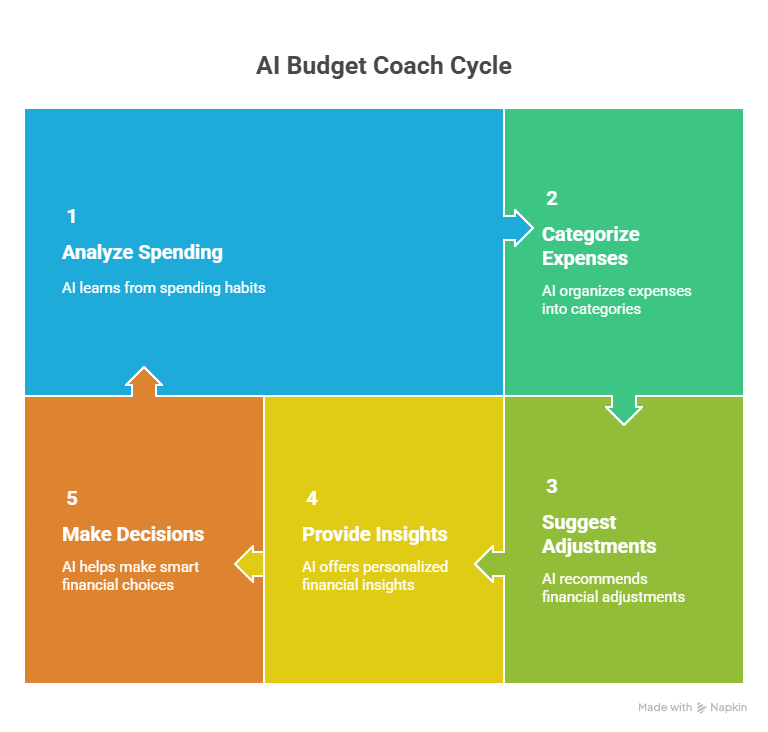

An AI budget coach is a smart virtual assistant using AI-powered data analysis and decision-making to help manage money. It learns from your spending habits, income patterns, and goals. Then it autonomously categorizes expenses, suggests adjustments, and nudges you toward smart financial decisions.

Rather than generic alerts, these agents offer personalized, context-aware insights—like flagging an unexpected subscription or recognizing a payday bump.

Story 1: Emily’s Small-Step Debt Freedom

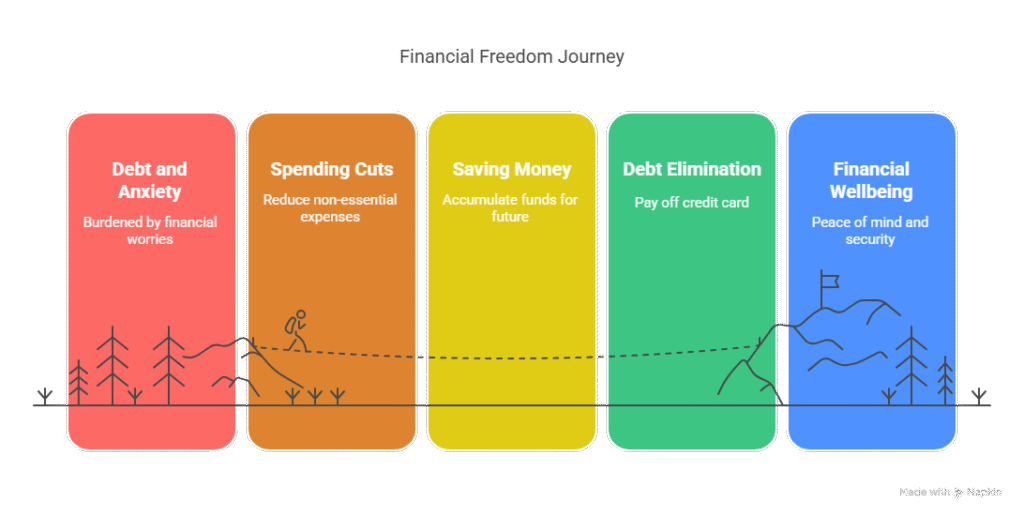

Meet Emily, a 28-year-old graphic designer in Denver. She juggles rent, utilities, groceries, and her weekly coffee habit. Despite trying budgeting apps, she often found herself broke before payday.

She turned to PocketPlan, an AI coaching app. At signup, the AI asked about her expenses and goals. It discovered she spent $14 weekly on coffee. So, the coach suggested auto-transferring $2 per day into savings and warned her when her coffee budget hit $10.

Over eight weeks:

- She cut non-essential spending by 12%

- Accumulated $200 in savings

- Paid off her $150 credit card balance

- Felt less anxious as pockets kept growing

Learning for you:

- Begin with one spending category worth adjusting

- Let the AI nudge with gentle rules

- Automate transfers to build momentum without thinking

With tiny nudges, Emily regained control — not with harsh discipline, but kindness.

Story 2: Mark’s Family Vacation Planning

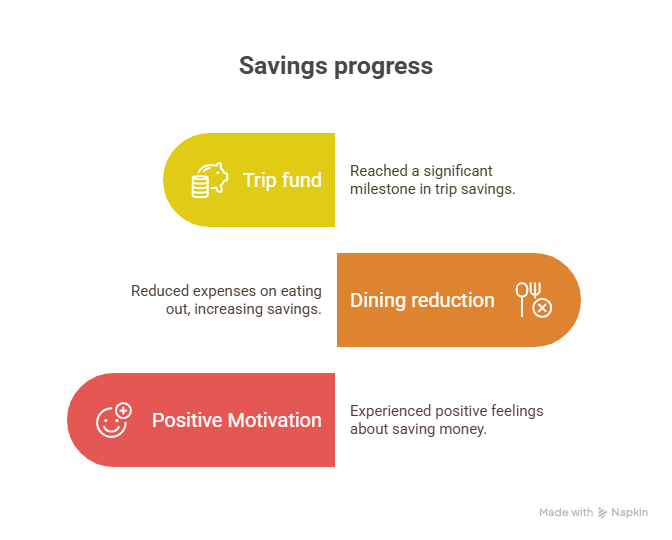

Meet Mark, a father of two living in Austin. He wanted a summer beach trip but struggled to squirrel money away amidst daily life expenses.

He tried SmartSave, a goal-oriented AI wallet. After setting a $1,200 vacation target, the agent created a virtual envelope. It tracked his spending—especially on dining and ride-shares. Because of that focus, it could suggest:

- A $15 weekly shift from dining to savings

- Automated $75 transfers after each paycheck

- Motivational alerts (“Halfway to goal—nice!”)

Within three months:

- He reached 80% of his trip fund

- Cut dining out by 15%

- Felt motivated rather than guilty

Tips to apply:

- Define one meaningful goal and set a clear amount

- Schedule automated transfers you won’t notice

- Use positive reinforcement, not shame

Mark’s family is heading to the beach—and it’s more than money saved; it’s family joy funded by small actions.

Story 3: Sarah’s First Investment Journey

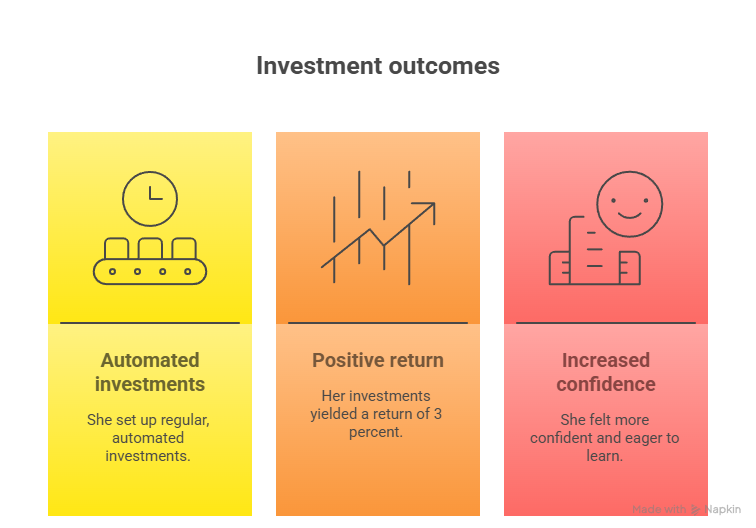

Meet Sarah, a 32-year-old nurse in Chicago. She always thought investing was for stockbrokers. She’d save a little, but never took the plunge.

Enter WealthWise, an AI-driven finance coach. Through a chat interface, it asked about her risk comfort, her saving goals, and time horizon. It created a micro-investing plan: allocate $50 monthly to a low-cost index fund.+

In three months:

- She established automated monthly investments

- Earned a 3% return

- Felt excited and confident to learn more

Key takeaways:

- Combine savings and investments in one app

- Learn through bite-sized insights

- Build habits with automatic transfers

Sarah now talks investing casually — she says “It’s like planting seeds monthly and checking how tall they grow.”

Why AI Agents Beat Traditional Tools

Barely customized spreadsheets or manual categories can’t compete with active, data-driven assistants.

AI budget coaches combine:

- Personalized nudges when you’re drifting off track

- Real-time expense tagging for clarity

- Automated rule adjustments when income or spending shifts

- Engaging tone that feels supportive, not judgmental

For example, if you overspend one week, the AI recalibrates. It might suggest increasing saving next paycheck, all communicated in a calm, friendly voice.

What You Can Do Today

To start using an AI budget coach:

- Choose a focused saving goal (e.g. “Save $500 for emergency”).

- Import your transactions for real-time tracking.

- Set up automated transfers tied to goal or spending checks.

- Enable meaningful alerts (like “Eating out limit reached”).

- Review and adjust quarterly—don’t just set and forget.

These agents give structure, feedback, and consistency—without nagging.

Beyond Budgeting: The Rise of Financial Lifestyle AI

AI budget coaches are evolving into holistic financial companions.

They now offer:

- Auto-switching to better financial products

- Personalized investment nudges

- Late-fee avoidance alerts

- Contextual learning, like “You’ve learned—now try this next step”

Remember Sarah? She’s now learning about robo-advisors and starting a retirement fund—all sourced from financial insight micro-prompts.

Conclusion

AI budget coaches are doing more than automating spreadsheets—they’re redefining personal financial care. Through Emily’s debt freedom, Mark’s vacation savings, and Sarah’s investment kickoff, you can see how smart agents blend data, behavior change, and helpful reminders into everyday tools.

Pick a goal—big or small—invite an AI coach into your finances, and let gentle, guided automation lead you there. It’s the calm confidence you didn’t know you could bring to your bank account.

References

- “Fintech’s AI Revolution,” Deloitte Insights, Mar 2025. https://www2.deloitte.com/fintech-ai

- “AI-Powered Personal Finance Apps,” CFPB Report, Feb 2025. https://www.consumerfinance.gov/reports/ai-apps

- “Behavioral Finance Meets Amazon AI,” MIT Sloan Review, Apr 2025. https://sloanreview.mit.edu/ai-finance